Why the state matters and the USA still dominates capitalism worldwide

The Making of Global Capitalism – The Political Economy of American Empire

By Leo Panitch and Sam Ginden (Verso Books 2012)

Reviewed by Dave Kellaway

‘In today’s world the multinationals operate outside nation states, there is a new global capitalist order in which no nation state is dominant’

‘ Europe was constructed against US capital and there was and is a real conflict of interests between these two powers

‘Neo-liberal capitalism means the state is in retreat and capitalists do what they like’

‘China, along with the other BRIC countries,is on the rise and challenging US world hegemony today’

‘Global recessions inevitably lead to beggar thy neighbour protectionist measures.’

‘The latest recession has been caused by the falling rate of profit’

Such statements have been made many times over the years by both mainstream and left wing analysts or commentators. Ginden and Panitch set out in this book to debunk each one of them. I remember myself listening to Ernest Mandel argue strongly about the contradictions between the US capitalists and European common market back in the 1970s and 80s. These authors show how at every step the US actually encouraged and helped build the EC because it served their interests as a modern system of capitalist management that seamlessly integrated their ideal of global capitalism.

What is this ideal type of global capitalism? It is one where there are little or no restrictions on foreign direct investment and where all states scrupulously observe the rules of the capitalist market, for example respecting contracts, paying down debts and outlawing any expropriation of capitalist property. What the book expertly shows is how achieving this state of affairs, albeit unevenly and with contradictions throughout the world, required a patient and resolute effort by the US state. Such an effort at times had to overcome the need to manage domestic US contradictions so that the bigger aim was achieved of securing a world where US capital can dominate. In this way they show how some authors have exaggerated the conflict between sectors of US capital which are supposedly more isolationist than others. What is also interesting about this whole story is how forming super cadre who follow the American way in international and national political and economic institutions, was and is, a key mechanism for domination.

This is confirmed by the fact that many key players in Europe for example Monti, the former Italian premier or Draghi, the European Bank leader or Lagarde , the French IMF leader, were all formed and trained in US economic institutions like Goldman Sachs. It is an interesting comment on how often the capitalists are much more systematically international in practice than the left. It even comes down to ideology and propaganda, there is reference in the book to how influential new management techniques by US business gurus were in the formative days of the EC. It made me also think of the Russian student I taught recently who was devouring the latest US business guru, translated into Russian of course!

You get two for one with this book. Not only do you get a richly detailed account of the rise of American capitalism into the leadership and building of global capitalism but you also have some very clear theoretical explanations about the relations between the state, the capitalist economy and politics. Just take their explanation of the notion of relative autonomy:

“It is in these terms that we should understand the ‘relative autonomy’ of capitalist states: not as being unconnected to capitalist classes, but rather as having autonomous capacities to act on behalf of the system as a whole. In this respect, capitalists are less likely to be able to see the forest for the trees than officials and politicians whose responsibilities are of a different order from that of turning a profit for a firm. But what these sates can autonomously do, or do in response to societal pressures, is ultimately limited by their dependence on the success of capital accumulation. It is above all in this sense that their autonomy is only relative” page 4

What makes capitalist states different from pre-capitalist states like feudal ones is the ‘ legal and organisational differentiation between state and economy. It is not a separation but a differentiation’ (page 3) because obviously as capitalism developed the state got more and more involved in economic matters especially in establishing the ‘juridical, regulatory and infrastructural framework ‘ (ibid). States were increasingly important in managing capitalist crises which could not be done directly by competing capitalist companies. At the same time states are dependent on the success capitalist accumulation for tax revenue and popular legitimacy. In a later chapter the authors show how the intervention of states led by the US and backed by the Federal reserve, were able to use international institutions (like the G8/G20, IMF, World bank, EC bodies) to limit the damage and prevent catastrophe in our present recession.

The way in which the state operates to maintain the system varies. In the UK both the Labour Party and the Con-Lib coalition are both effective managers of capitalist accumulation in the sense that they act in the overall interests of the capitalist class whether at one time this means deregulation and in another saving the banks or cutting the deficit. In Italy at present the state cannot allow the interests of one rather influential capitalist ,like Berlusconi, disrupt the overall smooth running of the system. However as we see in both cases the running of capitalist affairs is never smooth and is constrained by inter-capitalist (e.g. anti-EC factions) and inter-class constraints (e.g. trade union strength pre-Thatcher).

One essential point made by the authors is that deregulated, neo-liberal capitalism does not mean that the state is absent or in retreat. Paradoxically, de-regulation requires rules and procedures. There is a lot of work at national and international level to write down legal frameworks to ensure capital is free to move where it wants to make as much profit as it can. The book goes into great detail about how mechanisms like the international reserve currency, the move from sterling to gold then to the dollar was organised. This sometimes required the US to take measures which in the short term were not in the best immediate interests of its own capitalists – for example allowing some exchange controls from its European allies during the 1950s. The later chapters make very clear how the bank of last resort for world capital is essentially the Fed. The authors quote recently released information about how the Fed was secretly releasing funds to the biggest international banks during the depths of the crisis following the Lehman bank crash.

Another example of where this book cuts through some lazy sloganising is over US intervention in the Middle East. They show that is not primarily a question of keeping the oil price down but to “ensure the importance of oil in the international capitalist economy” (p103). Developing the Middle East as a place for efficient foreign direct investment and accumulation in general is a much more accurate way of explaining reality than talking of cheap oil.

China’s rise as a capitalist power is more realistically analysed than we often see. Its integration into the US world order is shown by the way it has adopted US conditions for foreign direct investment which are much freer than for Chinese private capital. Chinese acceptance of the rules and mechanisms of international finance is also clarified and its dependence on the dollar as they are the biggest holder of US treasury bonds(p 294).

Ginden and Panitch challenge the idea that the crisis has been caused by domestic over accumulation or imbalances between countries and instead argue that the extreme volatility of capitalist finance is the root cause. Today’s ongoing recession has, according to the authors, reinforced rather than weakened US global hegemony since there has been agreement for greater international regulation of the economy. This means adherence to rules and regulations determined essentially by the US.

One interesting consequence of the way the current capitalist crisis is being managed under US hegemony has been less likelihood of conflicts between states, which we saw following the 1930s depression, and more certain class conflict within capitalist states (p333). In fact we have not seen the protectionism of the interwar years and there has been a rise in conflict albeit within a context of defensive struggles without any real victories for working people. The relative prosperity of the postwar ‘mixed economy’ years when profits and wages both increased in Europe and the USA will not easily be reproduced in today’s capitalism. Similarly illusory is a return to a less finance centred capitalism – one that is a ‘real’ economy like the one union leaders or left reformists often invoke producing proper (British?) goods:

“Capitalist finance is in truth no less real than capitalist production—and not just because of the way it affects the rest of the economy during both boom and bust, but because it is integral to capitalist production and accumulation as well as to the extension and deepening of global capitalism.” p338

A key point for any of us trying to build an alternative that puts people before profit is made by Ginden and Panith at the end of the book. They state that the weakening of broadly socialist ideas such as collective services and a democratised state and economy through the twentieth century towards more acceptance of individualised consumerism by working people is a process that is now undermined. Capitalism can no longer provide this level of consumption on the same scale.

Finally the book finishes with a fraternal criticism of those movements that have emerged in the last decade that believe you can change the world without taking power. This whole book shows how the capitalist state, particularly the US one, fundamentally reproduces the conditions for this unfair and exploitative system. Without overthrowing that state and taking over the financial controls that govern investment and employment no real change is possible. They add nevertheless that the political forces necessary to do this will be different to the ones that ‘carried the socialist impulse’ in the last century.

This book is very useful and informative both for activists and students of political economy. It is possible to skim some of the details of the earlier history and focus on the sections concerning the postwar period, the European community, the present crisis and especially the key concepts and ideas which are established brilliantly in the first and last chapters.

Left Unity is active in movements and campaigns across the left, working to create an alternative to the main political parties.

About Left Unity

Read our manifesto

Left Unity is a member of the European Left Party.

Read the European Left Manifesto

ACTIVIST CALENDAR

Events and protests from around the movement, and local Left Unity meetings.

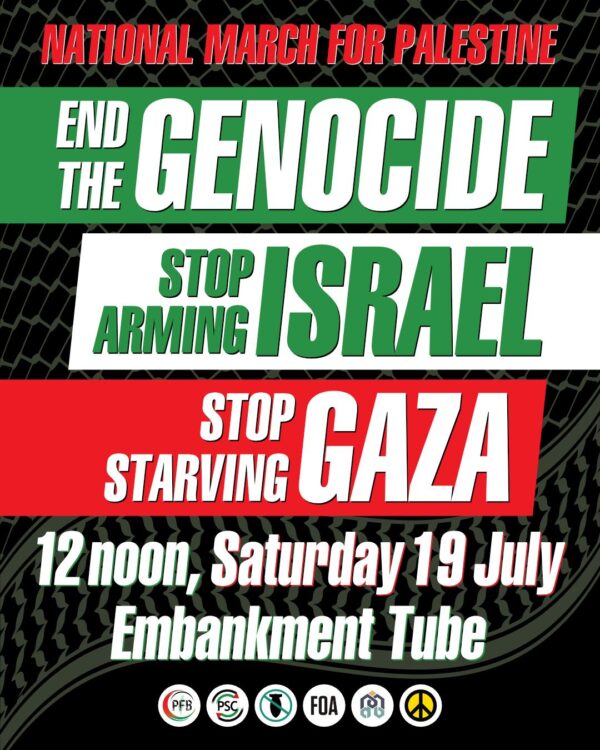

Saturday 19th July: End the Genocide – national march for Palestine

Join us to tell the government to end the genocide; stop arming Israel; and stop starving Gaza!

Summer University, 11-13 July, in Paris

Peace, planet, people: our common struggle

The EL’s annual summer university is taking place in Paris.

More events »

GET UPDATES

Sign up to the Left Unity email newsletter.

CAMPAIGNING MATERIALS

Get the latest Left Unity resources.