Working tax credits subsidise big corporations

Working tax credits subsidise big corporations to exploit poor people. Let’s have a mandatory living wage, says Salman Shaheen.

Working tax credits subsidise big corporations to exploit poor people. Let’s have a mandatory living wage, says Salman Shaheen.

Ed Miliband’s summer of silence has been criticised from the left as the perception grows that Labour has failed to provide a coherent and effective alternative to austerity. The standard riposte to those who claim there is little that now separates Labour from the Tories is to say look at the party’s achievements in government: working tax credits, the minimum wage.

Certainly both policies have been vital to offer some modest protection to the lowest paid workers from the full brunt of market forces. Certainly both are a darn sight kinder than the Tory bedroom tax. But the minimum wage, at £6.31 an hour, is not enough to meet the basic needs of Britain’s working people. Harder still for struggling families in London as rent rockets and the cost of living soars.

Working tax credits are a life line to people on the bread line. Around 5 million people claim working tax credits, costing £6 billion a year. This is a cost the taxpayer shoulders because we rightly accept that the tax system should be redistributive, that those who earn a little more should help those in more precarious positions. This is a cornerstone of social democracy.

But, in reality, working tax credits effectively subsidise big corporations to exploit poor people. Companies don’t pay their workers enough to live on, so the government tops up their wages, easing the pressure on employers to pay employees fairly. Now, as the government prepares to roll out its chaotic universal credit system, is the perfect time for Miliband to end his silence and enter the debate for a bold alternative.

Let’s stop subsidising some of the world’s biggest companies to exploit some of Britain’s poorest people. Let’s scrap tax credits. And let’s bring in a mandatory living wage that will ensure everyone has enough to lead a decent life. Of course, people will worry about the small family-owned cafes or the niche bookshops who struggle to turn a profit next to the likes of Starbucks and Amazon. But there are better, more targeted ways to support small local businesses than through tax credits.

Miliband has pledged to back a voluntary living wage. But when was the last time a big corporation voluntarily stopped exploiting someone? Labour needs to find its voice and it needs to deliver real policies that help people. Replacing tax credits with a mandatory living wage would be the perfect way to demonstrate a commitment to helping the crushed bottom under the boot of austerity, whilst at the same time saving £6 billion a year.

But in signing up to Conservative spending plans and refusing to pledge to repeal the bedroom tax, Miliband has shown he lacks the vision necessary to make policies that resonate with Labour’s core working class supporters. And while he refuses to speak out, the voices on the left are rising.

22 comments

22 responses to “Working tax credits subsidise big corporations”

Left Unity is active in movements and campaigns across the left, working to create an alternative to the main political parties.

About Left Unity

Read our manifesto

Left Unity is a member of the European Left Party.

Read the European Left Manifesto

ACTIVIST CALENDAR

Events and protests from around the movement, and local Left Unity meetings.

Saturday 10th January: No to Trump’s war on Venezuela

Protest outside Downing Street from 1 to 3pm.

More events »

GET UPDATES

Sign up to the Left Unity email newsletter.

CAMPAIGNING MATERIALS

Get the latest Left Unity resources.

Good to see a practical policy proposal …a positive statement of what an LU political program could contain rather than general ranting of anti capitalist slogans and “socialist demands”. But one policy in isolation is not enough. How much should the “living wage”be? How does it interface with the tax system?….no point in paying a living wage then allowing a big slice to be taken back via the tax system….the tax system needs rethinking…..what about new taxes on wealth, property, financial speculation, carbon, etc? If there is a substantial increase in the mandatory minimum/living wage how are small businesses to be assisted….what are the “better ways” Salman refers to?

LU needs to develop a joined up, coherent and comprehensive programme of policy and institutional change that can deliver a fairer and more just society that can be sustained within the carrying capacity of the planet.. I could go on but that would take up too much space here and would mean rewriting what I have already written in “Building a New Scotland”….a model for Scotland after independence but much of it applicable to the UK as a whole whether Scotland votes for independence or not…..email me at jim.osborne@talk21, com if you would like to read it and chew it over…..it may not have all the answers but it demonstrates the scope of what is required.

At present, the Conservatives are busy harmonising the corporate tax rates for big and small companies. You could help small businesses by lowering their tax rate, while raising rates for big companies back up to a sensible level. I agree one policy in isolation is not enough, indeed this isn’t even an LU policy, just some ideas I’m throwing out there for discussion. The policy commissions are having very fruitful debates on many issues, this is where the practical policy proposals will emerge.

I can’t quite agree. WTC and the minimum/living wage don’t have the same targets. While a living wage is essential, people on and above the living wage have and depend on WTC, it’s basically some of the wage rise which they didn’t get from corporations over the last four decades.

I think it’d be a mistake to simply cancel the WTC program without an impact analysis or looking at ways to protect income.

Of course. But one would set the new minimum wage above the point at which people stop being eligible for tax credits.

Uh…isn’t that rather high? I’m not sure of the exact calculations (is there a guide easier than the arcane HMRC site?) but isn’t there quite a long tail upwards?

(Also, remember there are two types of tax credit…childrens as well as working)

It’s all being merged into universal credit. I don’t think it’s that high to be honest, and shouldn’t we be pushing for higher wages?

This why I personally joined left unity. The desperation and endless catch 22 tax credit and minimum wage trap and the welfare state in general. Salmans point is a good starting point for real debate. But more than that its what matters to everyday people’s lives. I really believe £9 or £10 is a more realistic minimum. But I am looking forward to the debates this and others views on this subject.

Yes I agree, while I use the term living wage, I would be in favour of raising the minimum wage above what has presently been calculated as a ‘living wage’. Perhaps we could brand it a ‘decent wage’ – the level at which people can live a decent life.

“Living wage”, “decent wage”, whatever it is called has to be set within a sustainability context. Without becoming “big brother” and dictate what lifestyles people choose, there is a need to recognise that a “decent” standard of living is not the same as facilitating rampant consumerism. One area of policy is “resource efficiency” which includes themes such as extended product life spans, product reliability, the prohibition of “built in obsolescence”, materials recovery and recycling and so on. It is not beyond imagination that a more self sufficient society based on localisation of production will lead to reductions in the cost of living so that the “decent wage” could actually fall over time.

So what measures would you base it on, out of interest?

I find it unlikely that inflation would go negative, myself.

(And how would you deal with things like software obsolescence and support issues? Mandate open-source software for all official uses?)

Disclaimer: If Jim Osborne’s desire to protect the (no doubt deserving) poor from the inferno of “rampant consumerism” was meant ironically, please disregard the following.

It is quite upsetting, not to say worrying, to read, as a comment to Salman Shaheen’s article, the following comment by Jim Osborne:

““Living wage”, “decent wage”, whatever it is called has to be set within a sustainability context. Without becoming “big brother” and dictate what lifestyles people choose, there is a need to recognise that a “decent” standard of living is not the same as facilitating rampant consumerism. One area of policy is “resource efficiency” which includes themes such as extended product life spans, product reliability, the prohibition of “built in obsolescence”, materials recovery and recycling and so on. It is not beyond imagination that a more self sufficient society based on localisation of production will lead to reductions in the cost of living so that the “decent wage” could actually fall over time.”

Rampant consumerism? How dare anyone speak of “consumerism” when refering to the working population? This not only verges on obscenity in a country where, according to the City’s house organ, The Economist,

“In Solihull, a leafy suburb of Birmingham, unemployment is below average, but the cost-of-living crisis is acute. In 2010 only one client of its three Citizens Advice Bureaus (CAB) needed an emergency food parcel. Today they give out one every two days, some to people in work who run out of cash before payday. A record 16,000 people (nearly 8% of Solihull) passed through the charity’s advice cubicles in 2012. Most frequently, they sought help with debt.

One such customer, David, used to make a decent living as a skilled tradesman, but is now unemployed. He is behind on once-affordable gas, water and rent bills. His CAB adviser reckons he will never again earn what he used to, so is helping him cut costs he once considered essential, like internet access and mobile phones, from his family’s budget.

A Spartan future awaits the 40% of working-age Britons who, like David, are falling behind. They are in the bottom half of the income scale but, unlike the poorest 10%, predominantly live off wages, not benefits.” (The Economist, Aug. 10, 2013)

Does fighting “rampant consumerism” mean “helping him cut costs he once considered essential, like internet access and mobile phones, from his family’s budget.”?

In “Value, Price and Profit, Marx specified:” Besides this mere physical element, the value of labour is in every country determined by a traditional standard of life. It is not mere physical life, but it is the satisfaction of certain wants springing from the social conditions in which people are placed and reared up.”

Is maintaining this “traditional standard of life”, which today includes access to individual means of transportation (you need a car if your job is a couple of dozen miles from where you live, and often to have access to affordable grocery shopping and social services); it means having all the household labour saving appliances, and much more.

“Sustainability” is what the industrialists, finance moguls and government heads who meet at Davos (the World Economic Forum) call austerity:

It suffice to quote from the presentation of the World Economic Forum’s Sustainable Consumption” initiative (http://www.weforum.org/issues/sustainable-consumption)

“The Scaling Sustainable Consumption initiative aims to help create an enabling environment for businesses to deliver more value with less impact on the environment.”

(…)

Providing for the next generation of consumers in a sustainable manner presents both a challenge and an opportunity. Leaders can position themselves to succeed in this changing framework by redefining their strategies. New products, services and value chains can embrace “absolute sustainability”.

(…)

Our key question is: How can companies engage consumers to trigger simple behavioural shifts that enable more sustainable lifestyles and create business value?”

—————–

The movement does not need Fabian ladies-do-rightly to lecture employed, unemployed or retired workers to do more with less.

In my “Building a New Scotland” proposition I have set out the following as a possible model for a “target minimum annual income”….based on £8 per hour and a standard work week of 35 hours = £280 per week = £14560 per year. Nobody can be employed for less than this sum and where they can’t earn £14560 a year because of a disability, caring responsibilities, or unemployment for example then the shortfall is made up from the social security/welfare system. (Although unemployment is unlikely, at least beyond short periods of time, if other parts of the overall social model are also adopted). Nobody pays income tax on income below £14560 and retirement pensions are also subject to the same minimum income. Tax is raised from alternatives….taxation of wealth, property, financial speculation, carbon….etc. Pensions are paid from a sovereign wealth fund created by collectivising all occupational pension funds into one national “super fund”, which covers all citizens – this fund is also the source for capital investment in the economy. Where an SWF funded pension falls short of £14560 a state top up pension is paid (this state pension top up scheme is funded out of current general taxation).

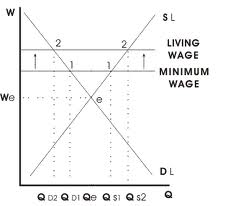

The blog used the wrong curves. The labour supply curve is inverted and s-shaped.

Salman, I don’t think abolishing tax credits for people with children working up to 16 hours a week and replacing with LW (London)rates at c.£8 would mean they would be better off.

Perhaps welfare advisors reading this could correct me but I believe tax credits raise the annual income of this group (which is mostly women btw) to £12 or 13 thousand (equivalent to full time MW). They would get roughly half that on 16 hours x LLW. Perhaps free full time childcare could make it worth their while, I don’t know.

I’ve got a dim memory that govt spends around £1.2bn on Sure Start children’s centres and around 20% children attend them, but in most cases parents have to pay some fees – it’s not statutory provision so some local authorities offer more generous discounts/free services than others. So this means a national child care provision might cost £6-8bn. Not a lot of money tbh but equal to that spent already on tax credits. The Tories are cutting children’s centre funding each year so it will be interesting to see what Labour does about it in their manifesto.

Also what’s important to many self-employed on tax credits is the continuity of income which helps during dry patches.

One of the reasons start-ups fail is lack of capital. Tax credits (in present form) provide in effect a minimum income guarantee without the incredibly stressful business of signing on and being sanctioned every five minutes.

Whilst I don’t think big business should get away with paying MW instead of LW (like Sainsbury’s) I can see a role for tax credits re: new co-operatives, which, like conventional start-ups, often fail for lack of initial capital.

As we’re concerned with a transitional programme I’d suggest investigating the cost of retaining tax credits but with MW linked to housing inflation, and then gradually raise to LW rates (also linked to housing inflation), at the same time expand childrens centres and extend free places.

But the first thing to do is to repeal anti-TU and anti-Justice legislation. The first has no upfront cost at all but you can bet Labour won’t do it. Access to Justice and fairness protection means restoring legal aid budget and it’s original scope (at a minimum).

I didn’t put children or part-time work into the equation, you’re right. When these are added in the picture becomes more complex. Scrapping tax credits is not a unilateral demand, rather I would prefer to see them rendered redundant over time as people’s wages are pushed above their threshold. It’s worth pointing out, though, that tax credits are not that stress free. There are plenty of examples of people being paid too much without their knowledge, then struggling to pay them back after the authorities have realised their error. Also, the CAB reports 9/10 clients are unprepared for the complexities universal credit will bring.

This article is an attack on the welfare state, anyway fixing wages is the same as fixing prices, command economics of failed communist states. But then again you would have know how social security works in this country to understand that Tax Credits, since they were introduced, have made a real significance in improving peoples lives. What you say? Lenin?, something he spouted in 1920? oh right that will really help us today.

1) This article is not an attack on the welfare state, don’t be silly.

2) Fixing wages is nothing like fixing prices, you’re being silly again.

3) I don’t know where you got the idea I’m a Leninist from, I’m not, you really are a very silly person.

Sorry Robbo.

Yes tax credits do make a difference to people’s lives, my family included. However this is a very complex benefit system that is gradually being rolled into one even more complicated process that only benefits austerity. What is more important is discussing these subjects no matter how complex ultimately to eventually implement policy that all have discussed and agree on which form or whatever amount of living wage is agreed. Disabled impaired men and woman should be allowed to live as freely or work without prejudice or be cared for without losing financial freedoms that should rightly be expected for the working class. In other words whatever solutions we initially implement should be the minimum of our aims and goals not the maximum.

Kathrine makes a valid point and I could have made my point in a better way than I did. But Kathrine could have made her own point without such a strident tone of debate….she writes lie she was poking a finger into your face whilst talking to you..it is unnecessary and is not the way to win hearts and minds to the cause.

The point I was trying to make is that collectively we have to now accept that we cannot continue producing and consuming the way we have been since WW2….the planet just does not have the resources or the ecosystems to support it. Clearly those with the most have to make the biggest changes and there is a need to define in some way what constitutes the basis for a “decent” life. Access to modern communications via the internet is certainly on the list as it is the basis for a modern participatory democracy, as is access to decent housing, quality food and energy. There is a point beyond which more consumption, whoever is doing it, is superfluous. Is there really a need for everyone to have a car?…..wouldn’t better public transport and community car sharing schemes, for example, do it? Like I said in my earlier post, defining a “living/decent” wage is just one component part of a wide ranging program of social transformation.

Kathrine is right aboht the term “sustainability” …it is a term with multiple meanings depending on wh is using it…..in the context of this debate I use it to mean environmental sustainability (the capacity of the planet to sustain human life). I am NOT using the term in the way the WEF/Davos crowd use it where what they are concerned with is making capitalism sustainable (including via austerity as Kathrine says)….capitalism isn’t sustainable….austerity is just a last ditch attempt to hang on for a bit longer.

Has anyone quoted Lenin in 1920 on current issues involving Tax credits and the minimum wage? If so, please point out where?

Tax credits improved people’s lives? Sure they have. But they are a two-edged sword, in that income becomes precarious because it is not directly linked to employment, and thereby vulnerable to being taken away as long as profit making is the driving force of the economy. If you accept that the economy has to run on ‘enterprise’ and profit, such benefits are in fact a deduction from that and in times when profitability is in decline, will inevitably come under attack from capital. The purpose of them in the first place is to mitigate the social tinder of inequality and provide a sop to stabilise capitalism. That was always the New Labour project – to stabilise capitalism. And once stabilised, capitalism inevitably goes on the attack through their ‘other team’ to hammer the beneficiaries of such stabilising sops.

I agree that the proposal to replace Tax Credits with a living or ‘decent’ wage are an attack on the ‘welfare state’, and to be opposed. What we rather need is a national political campaign by the left and the unions for a decent wage for all, and for the level of wages to be put in the hands of those who have to live on them. This means workers control of the level of a compulsory decent wage for all workers – to ensure above all that it be kept in line with inflation so no erosion of its real value can take place.

But focussing on wages narrowly is not enough. Because there are so many people in this society who are excluded from the possibility of working by the system as currently constituted. We also have to demand job-sharing on full pay – that is – cuts in hours with a corresponding increase in hourly rates to make up the shortfall, so that all who want employment but cannot find it can be given the chance to earn money. And more leisure time would be available to existing workers as well.

This idea that if a ‘decent wage’ is instituted, then tax credits should be abolished is an acceptance of the austerity mentality. Why not keep the tax credits, which would recede in importance obviously as real wages rose for most workers? They can be more and more used to fill any gaps, as a socialist full employment programme will still have to deal with issues like people unable to work through mental and physical disability etc.(who are also currently being punished by the austerity mongers). Tax Credits would still have relevance in improving the living standards of those layers and reversing the current vile attacks on them.

Yes I agree. I think perhaps I expressed my point too stridently, I don’t want to scrap tax credits in one fell swoop, I would rather see them recede in importance by rising wages and employment. I’m also sympathetic to the idea of job-sharing on full pay.

Salman – Just read your response; And the thing is, Universal Credit is a whole new omnishambles. There’s going to need to be a response to that which can unpick much of the worst damage it’ll cause…