The economy: it’s even worse than was thought

The latest GDP release from the Office for National Statistics was accompanied by a set of revisions to previous data. These now show that the downturn was more severe than had previously been estimated and that the British economy is even further away from recovery, says economist Michael Burke.

The latest GDP release from the Office for National Statistics was accompanied by a set of revisions to previous data. These now show that the downturn was more severe than had previously been estimated and that the British economy is even further away from recovery, says economist Michael Burke.

Previously, ONS data had shown that six years into economic slump the economy was still 2.6% below its pre-recession peak in the 1stquarter of 2008. Now it shows that the economy is actually 3.9% below its peak.

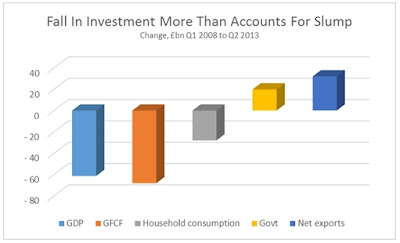

The economy is still £61bn below the peak level. Yet it remains the case that the fall in investment more than accounts for the entirety of the recession, as shown in Fig. 1. Investment (Gross Fixed Capital Formation) has fallen by £68bn. The other main component of GDP which has contracted is household consumption, which is down by £28bn. This demonstrates the effects of falling real wages on living standards. It effectively accounts for half the recession, but it is not as severe as the decline in investment.

By contrast government spending is £20bn higher, despite all the propaganda about the absolute priority of deficit reduction. This is because government policy is not primarily aimed at curbing spending at all, otherwise PFI, Trident and subsidies to corporations would all go. The aim is to boost profits, which means cutting wages, cutting government investment in areas where the private sector can return profits and redirecting the social surplus towards capital.

Net exports are also £32bn higher. The government and its supporters are inclined to blame Europe, or foreigners in general for their own failed economic policy. It should be noted that the rise in net exports has very little to do with the increased sale of goods and services overseas. Despite a very large devaluation for Sterling exports are only £6bn higher at the beginning of 2013 than at the beginning of 2008. By far the larger component of the rise in net exports has been the fall in imports, down £26bn over the same period. It seems that both households and firms in Britain are being priced out of world markets. It should be clear from the much greater fall in imports that it is Britain which is a drag on the world economy, not vice versa.

In fact the British economy has been one of the worst performers in the G7, which itself has performed very poorly. As a whole the G7 economy is just 1.1% above its pre-recession peak at the beginning of 2008. The British economy’s performance still 3.9% below its prior peak placing it in the rear of the G7, on a par with Japan and ahead only of Berlusconi’s Italy.

The slump has been followed by stagnation. The effect of the downward revisions to GDP is to increase the gap between the economy’s previous trend rate of growth and its current level. As a result the economy is already nearly 20% below its previous trend rate and even on official forecasts that gap is set to widen over the next period. The economy is about £350bn below its previous trend. This gives a measure of the scale of the crisis facing an incoming Labour government, which cannot be remedied without a commensurate level of investment in the economy.

The Tory-led government has no intention of increasing investment. The much-hyped infrastructure investment plan was entirely fake. As the chart from the Institute for Fiscal Studies reproduced below shows, government investment is being cut.

The Tories regard the returns available from this investment as belonging to the private sector. The cut to investment is to allow the private firms to invest and so reap the benefits. But there is no evidence that the private sector regards these as sufficiently profitable. As a result the cuts to government investment are simply exacerbating the slump in private investment. A Labour government would need to break this investment strike through a very large increase in government investment.

2 comments

2 responses to “The economy: it’s even worse than was thought”

Left Unity is active in movements and campaigns across the left, working to create an alternative to the main political parties.

About Left Unity

Read our manifesto

Left Unity is a member of the European Left Party.

Read the European Left Manifesto

ACTIVIST CALENDAR

Events and protests from around the movement, and local Left Unity meetings.

Saturday 10th January: No to Trump’s war on Venezuela

Protest outside Downing Street from 1 to 3pm.

More events »

GET UPDATES

Sign up to the Left Unity email newsletter.

CAMPAIGNING MATERIALS

Get the latest Left Unity resources.

Labour have said explicitly they won’t…this is the sort of thing which should really be noted rather than just reprinting articles, afaik.

BROKEN BRITISH POLITICS – MP’s PAY VS SOLDIERS

The average pay of a trained soldier is £14000 per annum .The pay of an MP is going to rise to £75000 with extra benefits on Child Expenses and Pensions .Where is the Justification in such a grotesque difference .Since when are MP’s subject to Post Traumatic Stress and serious injury, culminating in some cases to Suicide .More squaddies have committed suicide than have been killed by the Taliban .The only similarities in the work they do is that they both work to implement Government Policies here and abroad .Soldiers having lost limbs fighting for lost causes created by Government are treated to the same draconian measures as to fitness for work as other disabled people ,with contempt and deemed fit for Work by not fit for purpose ATOS .To ID Smith being an Ex Arms Dealer this is just part of a game .Wilberforce abolished manual slavery but we are still subjected to it Psychologically .http://brokenbritishpolitics.simplesite.com