Cyprus faces organised robbery as EU leaders seek economic and political control

George Venizelos examines the current economic crisis in Cyprus and looks at its political and economic roots.

The Eurogroup’s decision to proceed to a haircut on Cypriot savings accounts has caused mass discontent amongst the people of Cyprus and beyond. The decision of 15th March left the Cypriots shocked, angry, betrayed and swindled, after seeing their own savings sacrificed to save the banking sector. Over the past two weeks, Cyprus has faced a direct attack from the economic institutions of the European Union; on the one hand, the arrogant demand to force the people to pay for the financial crisis and on the other, the blackmail of ‘bailout or collapse’.

Opinion within Cypriot society

Opinion amongst the public differs, but the ordinary Cypriot people, the small savers, agreed that the decision was too much. The left – which until recently governed the island – blames the new conservative government, saying that they are leading Cyprus to bankruptcy through neo-liberalism, privatisation and EU policies which will bring a new type of slavery/colonisation to the island. But the politicians of the right and their supporters say that it hasn’t happened in their two weeks of government but during the past five years when AKEL governed the island.

Well, the truth hides somewhere in the middle, although many will disagree with this opinion. Indeed, the previous government of the mainstream left wanted to protect ordinary people from the tactics and the suggestions of the troika which would attack directly the lower layers of the society. Therefore they opposed in many ways the demands and suggestions of the EU which wanted to prevent a possible crisis in the near future in Cyprus. The government of AKEL appeared to resist but, in my opinion, did so only rhetorically. Indeed, it did not proceed to any unpopular measures but also did not proceed to any radical and drastic measures to protect the economy without making the poor pay. It took loans from Russia but the money was used to pay public sector strikers to return to their jobs and to help the country recover from the explosion at the naval base in the summer of 2011 which damaged the island’s main power station. Moreover, at the end of its term, the government itself invited the troika to the island to discuss possible pans for monetary aid.

Indeed, the crisis of the banking sector did not happen either in one night or in the two weeks of conservative government. However, it is true that AKEL was obviously a problematic negotiator with the troika since it did not want to follow their plans and so the leading powers of the EU waited patiently for the elections of last February. The EPP conference even took place in Nicosia, patronising the upcoming elections and spreading a message of friendship and future help if Anastasiades, the current conservative president, won the elections. This, interwoven with criticism of AKEL’s five years in office, led to the election of Anastasiades who was just what the European partners wanted as a negotiator.

The dilemma

Nevertheless, what has happened in the past ten days has left Cypriots in a state of uncertainty. A direct withdrawal of the people’s savings was, firstly, the worst economic decision and, secondly, a declaration of war between the strong and the weak of the eurozone. On that night, the Cypriot government faced the dilemma presented by the EU, bailout or collapse. In this respect, as the new president stated, ‘we chose the least bad option’ – the bailout. However, when the proposal was taken to the Cypriot parliament, it was rejected by every party apart from DISY (the party of government) which decided to abstain from the process. Almost every left wing party and organisation, together with the ordinary people of Europe, saluted the decision, including economists from around the world who were shocked by the proposal of the European partners regarding Cyprus. On the contrary, the leading EU countries most opposed to the Cypriot decision led the discussions the following week to exclude any alternative and any proposal from the Cypriot government, patronising the decision of the government and ultimately coercing it to accept the initial proposal a week later. The only difference at that point was the pressure of time and the fact that the Cypriot economy was about to collapse at any minute. For sure, a solution had to be found, but a bailout can only be described as a catastrophe. The confidence of the people was lost; the Cypriot market froze, ordinary citizens and businesspeople alike withdrew massive amounts of capital and sent it to other countries to protect themselves. Then the local market started shaking and sinking dramatically. In other words, the decisions taken in the past weeks paved the way for a massive capital withdrawal from the island, especially by Russian investors who kept massive amounts of money and investments in Cyprus.

The scenarios

Opinion within the country suggests that the EU’s unfriendly stance – and more specifically that of Germany – aimed to achieve three things:

a) Control of Cypriot natural gas which is due to be produced around 2017

b) An attack on Russian dirty money and ultimately its control

c) A solution to the Cypriot political problem, unsolved since 1974

The EU has been aware of money laundering in Cyprus since 2007, but no action was taken until just after the announcements of the start of gas drilling this year (Phileleftheros newspaper, March 2013). Cyprus cannot manage the drilling by itself and cannot maintain its economy on its own since it is based only on services, tourism and foreign investment. In this respect, the EU does not seem to like the path which Cyprus has chosen, that is, using resources outside the EU, with partners, such as the Russians, who do not get along with the hegemons of the EU, such as Germany. What we experience these days is the greediness of the leading countries within the EU, and particularly Germany, for economic and political control over the weaker countries of the south. By attacking the Cypriot economy in that way, the dominant EU powers would eventually be able to control the resources of the country, by exchanging money for natural gas and other political and economic rights for the price of bread.

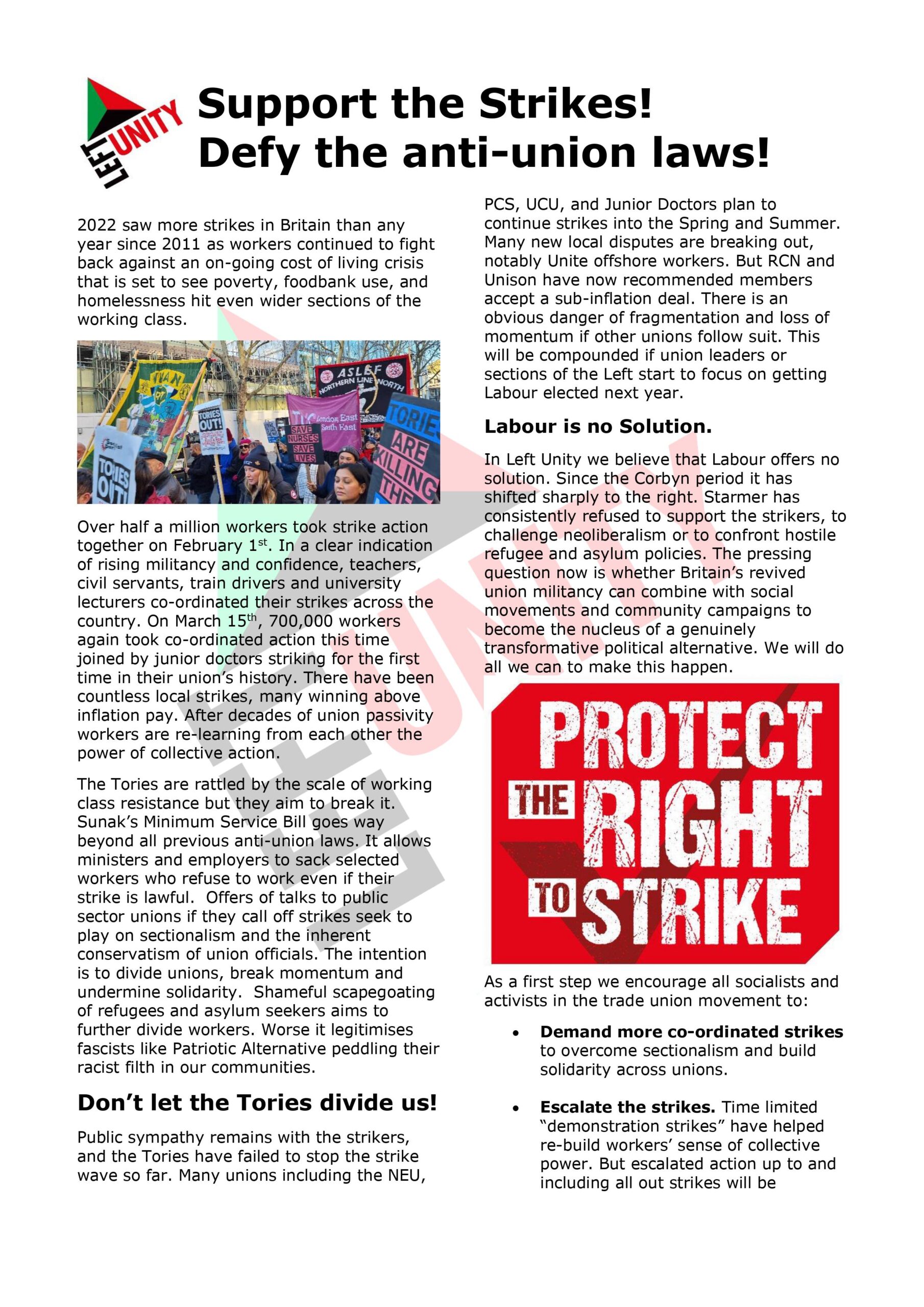

The reaction: the people and the movement

During the past five years and the previous presidency, when for example cuts were introduced, and the troika was invited to the island, the people scarcely came out onto the streets. When austerity was lurking, unlike Portugal, Spain and Greece, nothing happened in Cyprus in terms of mobilisation. However, when the first and more direct effect of austerity was at the gates, people went on protests and demonstrations outside parliament and the presidential palace. Sometimes, even twice a day, people gathered to oppose the decision imposed by the EU. Thousands of banking sector workers protested under threat of losing their jobs, thousands of students mobilised and led another demonstration of thousands across the capital. Every assembly of the parliament was accompanied by the voice of thousands outside the House trying to enter and clashing with the riot police. Demonstrations and protests followed in other cities, exposing the general discontent of the people towards the decision and the politics of austerity that will follow. I personally felt disappointed by fellow Cypriots for being ignorant, reluctant, apolitical and unaware of the socio-political and economical conditions in general. However, in the back of my head I trust the hot-blooded Cypriot rationale. The thin line between Europe and Middle East is drawn through Cyprus and when something is not accepted by its people, harsh consequences will follow. After the latest economic experience, every Cypriot realised the nature of the EU. The hegemonic nature of the EU and particularly Germany is now more visible than ever. The plans of the strong countries of the union for economic and political control are more obvious than ever. The route of resistance is not an easy one but from now on, the streets of Nicosia should be turned into battle fronts between oppressor and oppressed. It is more than clear that the economic downfall of Cyprus was planned and controlled for the reasons explained above. We need to continue building the consciousness of the people and oppose the neoliberal plans of the EU. Any path will be difficult but the people of Cyprus have already stated that it is better to be poor than to be slaves. The take it or leave it option given to the Cypriot government was an indirect blackmail to a weak Cyprus that is unable to measure and understand the level of the political game of the leading EU powers. We must examine other solutions and should be prepared to leave the eurozone of the opportunist partners at any time. To ‘save’ Cyprus in the way proposed by the troika is to maintain the current system. Yes, if we follow their tactics, we will eventually recover. But at what social and political cost? Capitalism has its booms and busts. After each boom there is a bust and vice versa. The point is not to remain part of this vicious circle and ultimately enter another, more serious, recession 30 years from now.

7 comments

7 responses to “Cyprus faces organised robbery as EU leaders seek economic and political control”

Left Unity is active in movements and campaigns across the left, working to create an alternative to the main political parties.

About Left Unity

Read our manifesto

Left Unity is a member of the European Left Party.

Read the European Left Manifesto

ACTIVIST CALENDAR

Events and protests from around the movement, and local Left Unity meetings.

Saturday 10th January: No to Trump’s war on Venezuela

Protest outside Downing Street from 1 to 3pm.

More events »

GET UPDATES

Sign up to the Left Unity email newsletter.

CAMPAIGNING MATERIALS

Get the latest Left Unity resources.

This article seriously needs editing and updating: the salient fact about the ultimate solution was that the so-called haircut will only be imposed on accounts holding above €100,000. Whilst there’s still much to disagree with, it’s certainly a huge improvement on the initial proposal of a haircut on ALL bank accounts, even for smaller sums.

With this solution, the EU has finally broken with one of the core principles of capitalism: the inviolability of private property. It’s done it for the wrong reasons (shoring up the banking system) and with a completely stop-gap method (an overnight raid on bank accounts, as opposed to a proper, universal tax on all wealth and assets) but the victims of this ‘robbery’, as the article calls it, are principally rich investors (many allegedly Russian tax evaders) who have benefited from overly generous interest rates for many years.

Throughout the Euro crisis, the financial sector has been able to pressure governments to guarantee the banking sector, ensuring that even the weakest banks don’t go to the wall: investors in ‘weaker’ Euro economies could rake in higher interest, safely assuming that the EU (and principally Germany, to whom the article ascribes all sorts of evil intentions without citing any sources) would be there to bail them out if their bank went bust.

These bail-outs have eaten up billions of public resources that could have been put to much better use invested in public services, for the greater good. With Cyprus, the same thing is happening again (€10 billion of the total €15.8 billion rescue package is being put up by the EU) – but uniqely, for the very first time, the rich are being made to contribute via a direct levy on their savings.

Don’t get me wrong: I do not agree with the EU’s aims (saving the financial system), nor with its methods (ram-raiding high bank accounts arbitrarily). There is no doubt that some deserving institutions will suffer (universities or hospitals with high bank balances) whilst others (canny investors who got out in time, or spread their assets over many smaller accounts) will get away scott free. And I’m under no illusion that any of this will benefit the people of Cyprus – quite the opposite.

Nonetheless, the principle that has been established here is important: private property is not sacrosanct, and if necessary, governments can and should intervene for the greater good: even if it means sacrificing economic sacred cows.

They might be loathe to admit it, but with the haircut on high-value Cypriot bank accounts, EU governments have essentially signed up to the very sensible insight that money is not holy: it is a human invention, and as such, it can and should be put to work for the benefit of humanity – not the other way round.

Steve,

I don’t think we should be under the illusion that the terms of the Cyprus bail out somehow constitute a weakening of the banking system. On the contrary, I believe that leftists should be alarmed at the increasing audacity of the ruling class and the ruthlessness of its tactics. The great financial markets hardly noticed the demise of Laiki Bank, and the far larger and sicker banks elsewhere in Europe are no nearer to collapse than they were before. It is worth noting also that interbank loans are expressly protected under the terms of the bail out, thus insulating any foreign banks who have had dealings with Cypriot banks.

The business about supposedly laundered Russian money in Cypriot banks is an old canard which the troika have, it appears, successfully deployed to discredit Cyprus. Russian money, laundered or otherwise, remains welcome in banks in Germany, France, Holland, US, UK etc. For anyone in any doubt, here is a succinct account of the way the term “tax haven” is manipulated by the propagandists: http://www.neurope.eu/node/120676.

In reality (as opposed to the fanciful narrative of tiny Cyprus laundering the oligarchs’ billions), many of the Russians (and other foreigners) who have accounts in Cyprus banks are moderately wealthy people who live and do business in Cyprus, therefore an attack on their bank accounts is also an attack on the wider Cypriot economy. Many of the Cypriot account holders with balances > 100,000 euros are small/medium sized businesses, which use their accounts to hold their customers’ money and to pay their suppliers and employees, all of whom will now lose out. So you can see then how the bank levy strikes not just at those with >100,00 euros in their account. Many of these businesses and individuals now face ruin. Thus, the bank levy together with capital controls, tax rises, and deep cuts to pensions, benefits and public sector jobs and salaries contribute to a perfect storm which will ravage the Cyprus economy. In short, everyone loses.

The troika appear to be confident that the effects of this will not be felt outside Cyprus (notwithstanding what Eurogroup President Dijsselbloem said about Cyprus being a model for future bailouts). The ruling class evidently do not see this as a breach of the principle of the guarantee of bank deposits. Rather, this measure is intended to signal that small countries like Cyprus will no longer be permitted to have large financial sectors, or indeed indulge in any species of economic activity which do not meet the approval of the EU hierarchy. It’s a warning to investors to put their money elsewhere.

Yes, some of the anti-German rhetoric is rather intemperate. BUT, it is an open secret that nothing happens in the eurozone without the agreement or active connivance of Germany. It is no coincidence that this brutal treatment of Cyprus happened in the run up to a German election. In my opinion, they have quite deliberately picked on a tiny, defenceless, friendless island in order to crush it in a show of strength intended to impress the German electorate as well as strike fear into other possible candidates for a bailout, such as Spain and Italy.

Regards,

Jason

To ‘save’ Cyprus in the way proposed by the troika is to maintain the current system. Yes, if we follow their tactics, we will eventually recover. But at what social and political cost? Capitalism has its booms and busts. After each boom there is a bust and vice versa

George Venizelos

The current mythology is that capitalism and its crises are like a wheel. They just go round and round and if we wait long enough a ‘boom’ is coming without a major war or a meltdown of society. If only life were that simple or that capitalism was eternal, then surely a resurrection of the old British Empire must be on the cards.

The other mythology regarding Cyprus is that this is about ‘taxing’ Russian money not about propping up Deutschebank in a beggar thy neighbour economic policy from the Franco-German controlled ECB.

Capitalism is bust and its banking institutions have fold, they choose which ones of course and under what reasons. Cyprus was chosen for Greece on its Independence Day (25th March) to show that it cannot go against the Troika, it cannot stand on its own two feet and it cannot negotiate with non-EU countries. Having collapsed the Cypriot banking system they aim to collapse Cyprus itself, looting its gas reserves for a pittance with a scorched earth economic policy ALL the politicians in the Cypriot parliament have given cover to.

How the people of Cyprus and Greece react to this latest Troika assault will be key in the coming months…

Details of the Cypriot Memorandum has arrived in the media.

GDP is allegedly to fall by 8% though it may be higher if there were more than 100,000 Cypriots employed in financial services of one sort or another.

E70 million in new property taxes

Business tax up from 10% to 12.5%

Wage cuts 4.5% for those up to E1k

6.5% wage reductions for wages up to E1.5k

8.5% wage reductions for wages up to E2k

Reducing the public sector

Privatisations to bring in E1.4b from 2013-16

VAT from 17% to 19%

Add losses from bank deposits for govt institutions such as hospitals and educational institutions and the hit is even higher.

Finance Minister after signing the handover of Cyprus to the banksters resigned yesterday to be pensioned off with some offshore bonus no doubt, whilst the Cypriot nation will have to scavenge in dustbins to make ends meet…

This article was not to inform about the numbers, rates and percentages were decided by the troika. its aim was to show briefly a short story before the current events, the public opinion, but also the nature of the EU and Germany i.e. hegemony, political and economic imperialism and so on. Just that, i small comment on the first lines of the first comment made by Vangelis

We are back to this unfortunately, again…

Capital Volume Three (Chapter XXXIII):

“The credit system, which has as its focus in the so-called national banks and the big money-lenders and usurers surrounding them, constitutes enormous centralisation, and gives to this class of parasites the fabulous power, not only to periodically despoil industrial capitalists, but also to interfere in actual production in a most dangerous manner…”

“The Acts of 1844 and 1845 are proof of the growing power of these bandits.”

Marx

They now announced that Cypru’s depression will be 13.7% as announced by Stylianidis the Govt Spokesperson. It will be a lot worse if they leave the Euro it will ‘be a jump into the abyss’. Before the measures they were predicting a GDP fall of 3.5%. The Euro-lackeys have no limit to stupidity pretending what has occurred is leap into paradise not hell…