Cypriot bank heist – the Eurozone crisis re-ignites

UPDATE: Cyprus and the division in the union

Kevin Ovenden updates his earlier article on the crisis devastating Cyprus.

Since then events have proceeded rapidly and dramatically. They will continue to do so. This introductory update is meant to highlight the political significance of some of those developments in a fast moving crisis.

1) Despite desperate protestations it is now clear, as stated below, that it was the Cypriot delegation in talks with the Troika in the early hours of Saturday morning that opted to sacrifice the mass of the population through raiding whatever deposits they had in the domestic banking system.

Centre-right Cypriot president Nikos Anastasiadis was caught between Scylla and Charybdis: between the demand that depositors take a “hair-cut” (a forced “bail-in”) of €5.8 billion in return for a bail-out of €10 billion for the banks (plus austerity piled on an economy in a double-dip recession) on the one hand. On the other was the settled policy of the Cypriot elite to maintain its role as a tax-haven for hot and dodgy money – two thirds of it from Russian oligarchs.

The IMF and German Finance Ministry were prepared to throw the burden onto Russian capitalists; Anastasiadis opted to spread it to the Cypriot pensioner, worker, farmer and struggling hotelier.

2) No one in the talks says that the outcome – both the proposed measures and the obvious social/political upheaval that followed – was intended. The dysfunctionality of the European response to a now renewed crisis could not be clearer. It is as if all the principal actors have chosen to be the prisoner of events and then – by way of a kind of collective Stockholm Syndrome – disavow responsibility for their own actions.

3) The deal was, entirely predictably, both unacceptable to the mass of the Cypriot population and also seen near universally as a harbinger of further bank heists, the rational response to which is to get your money out, thus precipitating the kind of 1930s bank-run that policy-makers from Ben Bernanke to Gordon Brown congratulated themselves four years ago on avoiding.

The bank robbery was also viscerally opposed by two other groups.

First, the Cypriot business class. It has been utterly dependent on the island’s tax-haven status for a decade and a half. It rebelled. One of its main spokespeople in the US, the former governor of the central bank of Cyprus Athanasios Orphanides, told any business journalist who would listen on Tuesday that the powerful states of the EU had enforced a kind of apartheid across the continent where the law facilitated the expropriation of the weak by the strong.

He virtually genuflected in front of the Statue of Liberty, hailing the doctrine of equality before the law in an effort to persuade Wall Street and Capitol Hill of the unfairness of it all.

Second, Moscow. Staggeringly, the Eurozone finance ministers did not even inform, let alone consult, the Russian government about their plan to extort possibly up to €4 billion from Russian business interests.

Russia’s president Vladimir Putin was rebuffed and his government moved swiftly to explore its own independent intervention. There is a deep, bitter division between Russia’s oligarchs, with Putin at the head of the state and representing one wing. He indicated that there were certain hostile interests whose hair he would shed no tears over clipping. The Russian finance ministry toyed with demanding a version of the Lagarde List – an inventory of dodgy dealing modelled on the IMF chief’s list of the Greek rich’s overseas holdings.

But whether it was friends or factional opponents of the Russian government who were to suffer, Putin’s position was clear. If any oligarch was to get a buzz cut, have their liquidity frozen or be thrown in the slammer, it was to be a Kremlin decision and no one else’s.

The Cypriot finance minister tendered his resignation; it was not accepted. So he headed off to Moscow for talks while his bosses sought renegotiation with the Troika and getting something, anything, through the Cypriot parliament.

4) On Tuesday the Cypriot parliament not only rejected the original deal, it rejected a revised package exempting those with deposits under €20,000.

It didn’t just reject it. Not a single MP voted for it. Thirty-six MPs voted against, 19 of the president’s party’s MPs abstained. No one voted for.

The Cypriot vote is a watershed. For the first time in three years of the banking and sovereign debt crisis in Europe an institution has voted no. That crisis is, of course, an expression of a deeper global slump. But the ways it has manifested have depended on the particular architecture of the competing interests that make up the EU.

The Greek parliament – at the price of bleeding the political centre – voted through the savage austerity memoranda, which in 2011 also meant a hit for holders of Greek sovereign debt. That move pushed the Cypriot banks over the edge.

The Italian political class, in its majority, voted for the pain and accepted, as did their Greek counterparts, the imposition of a non-elected prime minister, Mario Monti, to see it through. Last month saw an electoral revolt against the Italian political class.

Now there is little Cyprus. Not only the mass of people, but now also an institution – the Cypriot parliament – has said no. A small child (Cyprus joined the EU in 2004 and the single currency in 2008, accounting for just 0.2 percent of the union’s economic output) has told the rest that the emperor has no clothes.

The profound significance of that will play out as there is now both a desperate scramble to reassemble some deal over Cyprus’s banks (Russian takeover? Exceptional European Central Bank cash? Creative destruction?) and deepening opprobrium across the south of Europe at those politicians who said that the only game in town was austerity in order to secure a bailout.

5) The failure of the Cypriot parliament to agree to the bank heist on Tuesday was total. The political positions of the MPs, still more so the interests of the conflicting social classes in Cyprus, are far from uniform.

With the Cypriot business class opposing the Troika, with Russian-oligarch depositors alienated and with Moscow floating alternatives, a number of even centre-right MPs could find a backbone. Even those of Anastasiades’ Democratic Rally could slither into abstention.

But those parameters will change. In the combination of conflicting pressures that produced the Cypriot No there is one central element for the radical left. It is the mobilisation – and with it political agency – of the mass of the people in Cyprus who took to the streets outside the parliament on Tuesday with the backing of, among others, the official opposition Akel party.

That means not being oblivious to the cracks and fissures that are opening up in official politics as a parliament of an EU state bucks the trend. But it also means firmly standing independent of those conflicting elite interests, even while exploiting their mutual clashes.

All sorts of voices in Cyprus and across Europe will now seek to gather political strength to plot their preferred way out the crisis.

As the piece below argues – the radical left should have its own voice, based upon extending the kind of mobilisations we’ve seen in Cyprus so far and upon a trajectory of fundamentally breaking with a failed system.

Kevin Ovenden on the dangers posed to the whole of the Eurozone by the Cyprus bank crisis and its immediate repercussions in Greece.

Two months ago, perennial optimists were telling us that the worst of the Eurozone crisis was probably over. Then came the Italian election. Now the great Cypriot bank heist. By Sunday morning it was dawning on tens of millions of people what had happened, as the news spread from the specialist financial commentary to front pages and top television news across the continent.

At one stroke, the Troika of the Eurozone finance ministers, European Central Bank and International Monetary Fund had, with the new right wing Cypriot government, stolen between 6.7 and 9.9 percent of the money of all depositors in Cyprus’s ailing banks. All in the name of a bank rescue. When the leading capitalist states moved in 2008 to rescue the banks it was through taking on debt themselves and guaranteeing small and medium deposits in order to prevent a run on the banking system following the collapse of Lehman Brothers. The public, of course, was then to be squeezed in the name of reducing the debt that was now on the public books. Now, nearly five years on, the “rescue” means direct robbery of the depositor.

It’s as if as the crisis has continued and deepened, the capitalist system has become auto-cannibalisitic. What was meant to be sacred – private property and the essential private contractual relationship – has become profaned; not at the hands of some North Korean “communist terror”, but by the partisans of re-tubocharging the neo-liberal model, which is what the austerity is all about.

Writing in the Financial Times, Wolfgang Munchau spelled out the consequence: “If one wanted to feed the political mood of insurrection in southern Europe, this was the way to do it. The long-term political damage of this agreement is going to be huge. In the short term, the danger consists of a generalised bank run, not just in Cyprus.”

The banks in Cyprus and Greece are closed today for the Orthodox Clean Monday holiday. The Cypriot parliament is in emergency session to try to pass the measures while its government also seeks to renegotiate them. The potential in the coming days and weeks for a rapid spread of this phase of the crisis and for a dramatic social and political rupture is immense. It’s not just one thing; it’s one damn thing after another. The political instability, worsening economic outlook and rising resistance are spread across southern Europe and elsewhere. This sudden sharpening of the crisis poses acutely the strategic questions for the labour movement and the left.

The banks in Cyprus and Greece are closed today for the Orthodox Clean Monday holiday. The Cypriot parliament is in emergency session to try to pass the measures while its government also seeks to renegotiate them. The potential in the coming days and weeks for a rapid spread of this phase of the crisis and for a dramatic social and political rupture is immense. It’s not just one thing; it’s one damn thing after another. The political instability, worsening economic outlook and rising resistance are spread across southern Europe and elsewhere. This sudden sharpening of the crisis poses acutely the strategic questions for the labour movement and the left.

While the German government and its representatives in the European institutions remain utterly rigid in enforcing an austerity that is failing, they are not alone in hurtling over the cliff – as the dogma of the Cameron government in Britain, which is not in the euro, shows again this week in the face of mounting evidence of further economic collapse. The government of Nicos Anastasiades in Cyprus slipped out carefully selected and self-serving details over the weekend, claiming that it had bravely fought German demands and that the island had been overwhelmed by a foreign power from without – comparing the economic disaster now with the Turkish invasion of 1974.

On one level, it’s true that Anastasiades bridled at the initial German/Troika proposal. But that was to throw the burden of bank theft almost wholly onto large depositors, those with over €100,000. The Cypriot government was desperate to keep its status as a home for hot money, a policy that had contributed to the massive overextension of Cyprus’s banks so that their business swelled to seven times the size of the actual economy. Much of the cash in the banks – €20 billion – is from Russia’s oligarchs. So it was the centre-right in Cyprus that decided to offer up workers, pensioners, farmers and small businessmen to propitiate the banks and their Troika enforcers, as Athenian king Aegeus in myth sacrificed the city’s youth to the Cretan Minotaur.

Now, faced with an enormous backlash, which staggeringly commentators say was not predicted by the geniuses who run the Cypriot government and Euro-institutions, they are looking to tilt the burden back towards squeezing the Russians and others. It’s a lose-lose situation. Whatever the Cypriot parliament decides today, the rich will withdraw their deposits anyway, ending Cyprus’s status as money laundry of the south (a barely concealed aim of Berlin and Brussels) and so will the middling and poor rest when the banks reopen. As Munchau says, they will be acting rationally. If others withdraw money, then the banks will be in further trouble, which means more austerity with the possibility of a further bank heist – so you had better get out now as well.

There is immediate spill-over in Greece. The Cypriot banks in Greece will now be included in the Greek banking system. But who will recapitalise them – to the tune of something like €2 billion? The money from the last round of the Greek bailout has withered as austerity has deepened the slump. Greek depositors have €13 billion in Cypriot banks in Greece, principally the Cyprus Bank and Laiki, which the Troika has said it will pull the plugs on if there is no agreement in Cyprus to raid the deposits. Why on earth should anyone leave their money in the Greek outposts of those banks? This question will hit this week when the banks reopen in an atmosphere of not only ongoing social rage but of a further moment of political crisis in Greece.

The government of Antonis Samaras tried to play poker with the Troika a few weeks ago. He wants to appear tough in the negotiations and, more importantly, his government has not been able to drive through all the measures demanded. So the Troika left Athens without closing a new deal. The last time this happened under Pasok’s Evangelos Venizelos, it took the imposition of a poll tax on property to get the Troika to come back and deal. People in Greece are asking what now must be offered up to the monster? One obvious answer, post-Cyprus, is their deposits.

The intersection of political and economic crisis poses a major systemic danger. An accident can happen at every level: in the vote in the Cypriot parliament; in withdrawals by big investors (mainly Russians); in a run by the mass of depositors; in a spread of the bank run to Greece and the south; in a new round of austerity by the Greek state to recapitalise the banks; in the political impotence of Samaras’s tripartite government to vote through the measures, still less enforce them. And the Cypriot bank job is set to exacerbate geo-political tensions in the eastern Mediterranean. The government is promising a share of future profits from gas extraction to those (principally Russians) who keep their money in the country for the next two years. But the recently discovered gas field has yet to be exploited. And rights over it are contested by Greek Cyprus, Israel, Lebanon and Turkey.

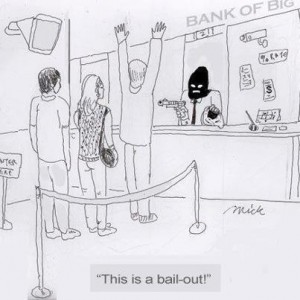

The government of Samaras, a hard nationalist who rejoined the New Democracy party in Greece after his own chauvinist party hit the rocks a few years ago, is toying with unilaterally declaring an Exclusive Economic Zone in the Aegean – in flat opposition to Turkey. The crisis is not waiting for the coming of an anti-austerity government, still less a consortium of some European governments which might together push for an alternative. People are not only being squeezed and having publicly-owned assets handed to the 1 percent; they are now being directly robbed as surely as if at gunpoint.

There are two broad lines of argument the radical left can take. And two general directions of travel. First, we can say that the problem is Germany; that Angela Merkel has put bank deposits at risk; that it is the left, not the partisans of neo-liberalism, which can ensure the basic inviolability of the private financial transaction; and that the agency for an alternative to austerity is institutional – a bloc of governments of varying hue that can stand up to the mafia in Berlin and Brussels.

There is certainly propaganda merit in showing that it is the defenders of neo-liberalism and not the left that have inflicted the nightmare on anyone who has a bit of money in the bank. But what would it mean to say that we will defend the little person in Cyprus and elsewhere. It would mean taking control of the banks? The Cypriot state – with overnight bans on electronic transfers and other withdrawals – has just shown that this is not only possible, but and for its own purposes, is actually how this free market system operates. Bank nationalisation and capital controls would entail directly standing up to the blackmail issued by big capitalists and the banks and enforced by their consiglieri in institutions such as those making up the Troika.

It would mean nationalising the currency – a direct break or rupture with the Eurozone and EU. In other words, if it was to mean anything now to the people who are suffering in Cyprus, it would entail a radical anti-institutional break. It would mean the second direction of travel that is open to what the left can try to do and argue for. That is to say that if the agencies of capitalism, in the interests of capitalism, can take over the banks and seize deposits, then so can the left for entirely different interests and with different effect. It’s tempting to say that where the liberal capitalists fail in their solemn undertaking to preserve the holiness of the private contract, the left can succeed and in so doing can even attract as part of a “hegemonic bloc” sections of capital that lose out in the “bailout”.

But if they cannot succeed, there is no reason to imagine that we can. Rather, there is every reason to base our arguments and agitation on an anti-capitalist position. Depositors in banks are not a social class, are not a uniform interest group, are not a potential bloc that the left can mobilise, lead and rest on. For us, nationalising the banks means protecting working people and the middle class at the expense of big business and finance. That means further measures that impinge on capitalism. The debate over such measures, certainly for us in Britain, might have seemed abstruse over the last couple of years. After all, wasn’t the central issue the bringing into government of at least some government that was opposed to the austerity madness? The problem is that the Cypriot heist shows that the question of whether a renegotiation of austerity or a radical rupture with it is posed now – not as a policy dilemma of government, but as a political argument around which masses of people may be mobilised to have political effect.

And Cyprus did have a government opposed to austerity: its first ever Communist President, Demetris Chrisofias. It sought exactly to find allies among governments of the south and to mitigate the austerity, while saying that things such as taking over the banks were at best a provocation that would prevent winning broader political support and were at worst futile. The futility was in not taking radical measures. Chrisofias lost the election last month.

What the left says and does now matters. First, can it encourage radical mass mobilisation that can shift the political calculus. If it does not, the rise of the fascist Golden Dawn in Greece shows that there are others who will. Secondly, extending and popularising arguments against the banks, big capital, and for a rupture with both impacts on whatever outcome there is from future elections. We want the right out and the left in. But will that left follow the path of Chrisofias or a different one? In large part that depends on whether it comes in on the back of a rising resistance and a social agency that is posing radical political answers. Last year, so much of that seemed like a luxurious or even petty-fogging distinction. But the actual dilemma is not in the future – to be faced by possibly a government led by the radical left Syriza party in Greece, or some equivalent elsewhere. It is posed now in what the social reaction is to this extreme moment in Cyprus, with its implications elsewhere.

Alexis Tsipras, the leader of Syriza, was in Britain at the end of last week. He repeated his call at the time of the Greek general elections last summer for the holding of a modern version of the London conference of 1953 which forgave 60 percent of West German debt. Now, from the point of view of those of us in London – home to so many of the banking leviathans – championing writing off debt against our government and the City has great merit. Indeed, arguing to seize the £777 billion of idle deposits in Britain’s banks and using them for investment also has great value.

But as the anti-capitalist writer and activist Panagiotis Sotiris has argued, the circumstances for such a conference do not obtain as they did in 1953: the beginning of the long boom, with fears of West Germany being drawn towards the Soviet camp, with a confident US able to underwrite a Marshall Plan. Above all, the governments and institutions remain wedded to one another and to austerity. It was in the name of the national that Anastasiadis decided to bleed the people of Cyprus in order to remain a financial facility for dubious Russian money. Increasing numbers of working people, the poor, farmers and sections of the middle class are not, however, wedded to the failed policy: as the Italian election showed.

The central question posed for the left is whether we can speak to them, not with the aim of drawing them into a bloc with a section of the elites that have failed. But to create a new, powerful political pole that strikes at the root of the problem and rests on the kind of social force that we saw two years ago topple Mubarak where decades of politicking had failed.

Tsipras told the audience at a public meeting in London that a large majority expected Syriza to win the next election, whenever that is. (And everyone on the left everywhere will be hoping that Syriza and the left as a whole do win.) But he added that the same majority did not expect anything to change. A part of transforming that hopelessness, pronounced elsewhere as well, is for the left to base itself squarely on building the widest effective resistance now, and articulating a political vision that inspires confidence that it will bring change, because it is based not on the ambiguities and triangulations that have seen the centre-left enervated across the continent, but on a radical rupture with a system that has failed.

Cyprus and our response to it is a moment to advance an argument for just such a break.

3 comments

3 responses to “Cypriot bank heist – the Eurozone crisis re-ignites”

Left Unity is active in movements and campaigns across the left, working to create an alternative to the main political parties.

About Left Unity

Read our manifesto

Left Unity is a member of the European Left Party.

Read the European Left Manifesto

ACTIVIST CALENDAR

Events and protests from around the movement, and local Left Unity meetings.

ongoing

Just Stop Oil – Slow Marches

Slow marches are still legal (so LOW RISK of arrest), and are extremely effective. The plan is to keep up the pressure on this ecocidal government to stop all new fossil fuel licences.

Saturday 27th April: national march for Palestine

National demonstration.

Ceasefire NOW! Stop the Genocide in Gaza: Assemble 12 noon Central London

Full details to follow

More events »

GET UPDATES

Sign up to the Left Unity email newsletter.

CAMPAIGNING MATERIALS

Get the latest Left Unity resources.

The role of AKEL the sister party of the Greek KKE is ignored for political reasons to show that the ‘Left’ when in power, isn’t involved in implementing IMF imposed austerity programmes (since the era of Milosevic…)

Christofias AKELs leader agreed to the Troika coming into Cyprus after running the country for 5 years and now the German dominated ECB wants to control and centralise all banks in the EU (deciding who gets what loans and for what) so it can dictate monetary policy accordingly, thus ending the independence of ALL nation states, so they embarked on a neo-fascist measures of robbing peoples money under the guise of ‘money laundering’ whereas no such reasons apply for Luxembourg, Isle of MAN etc or when Daxia asked for E100b and got it. After all it was a French bank so it has importance. Greek ones can go to the wall.

American interests are about selling oil and gas to Europe and minimising the EU’s dependence on Russian oil and gas imports. Cyprus has tonnes of deposits, it called in Israeli companies (ie the USA) to extract these resources but none has been sold as they are sitting on it and they have enforced bankruptcy on the island by cutting off the money supply to Cypriot banks. Turkey obviously threatened to blockade Cyprus if it extracted these deposits so they had to rely on a superpower for cover, but now this superpower is out to loot them dry.

Now they have to rely to see what they can get from the Russians if the Americans allow them that is as the last time the Cypriots went against the Americans in the Kofi Annan bi-zone neo-colonial occupation plan, they ended up having many problems, from planes dropping mysteriously out of the sky to allegations that the ex-Premier Papadopoulos was poisoned and his body being stolen from a grave.

This is a re-run of Argentina as the trust in banking has collapsed (banks will be closed for the foreseeable future) by the Eurogroup (Greece voted for the measure) and they want the Cyprus banking system annihilated. The NO vote is the start of the break up of the EZ as there are no limits to the extent the ECB will go to prop up banksters and hoepfully the beginning of the first Iceland within the EZ, where a population can annul all foreign debts and start again afresh. But to do that one has to restore a national currency, capital controls etc and control your own resources and sell them if you want to the highest bidder, not be bankrupted by the ECB so they can then buy your resources for peanuts…

21.The government of Samaras, a hard nationalist who rejoined the New Democracy party in Greece after his own chauvinist party hit the rocks a few years ago, is toying with unilaterally declaring an Exclusive Economic Zone in the Aegean – in flat opposition to Turkey.

Kevin Ovenden

Such a ‘hard nationalist’ is Samaras that when he fought the last election on the platform of the Euro or the Drachma he supported the …Euro.

SInce when does Turkey have rights to the Aegean?

He just voted with the Eurogroup to destroy Cyprus, another sign of ‘hard nationalism’ in that glorious tradition of the Greek ruling class, which allways sided with foreign powers in its history…

He is now trying to flog off Greek importing natural gas companies to the Americans at half the price that they will go to the Russians, another sign of ‘hard nationalism’…

Samaras, PASOK and the ex-members of Syriza in the Dem Left are just EU quislings pure and simple.

British bases…

But there is a British base on Cyprus and taking into account Britains colonial past on the island and its role against Makarios, to believe America will give up the island without a fight, I find it hard to believe. Anastasiadis the current President voted for the Anan plan so did Christofias in Akel (not Akel as a whole)

and he is still looking to get the money for the Eurogroup by looting Cypriots national pension pots, restructuring the Russian loans outstanding and possibly selling off gas fields whilst attempting to remain in the EZ. Having de facto imposed a haircut on Russian money they have destroyed the banking sector overnight (knock on effects will be mass unemployment, property collapses, political instability etc). The EZ was a disaster waiting to happen now its just a total farce with a beggar thy neighbour ‘economic’ policy which aims to serve the unelected banksters and their big industrialist friends in the centre and the rest can go to the wall…

14.As long as imperialism exists and Greece is a neo-colonial muppet Cyprus will always be at the behest of world powers who will do what they want when they want to due to its geostrategic location (spying base for the Arab world). Putin called for the ending of the dollar as a reserve currency at the G20 again and we are in the midst of a currency war and Cyprus is a small pawn in the middle.

The only positive is its part of the EZ chain and even if a small link is broken in that chain, the link could break.

Update 24. 03. 13

IMF is playing hardball on media reports now asking for a 60% cut in bank deposits over E100k.

Eurogroup meeting been postponed once more this Sunday and will allegedly meet tomorrow now ensuring the whole process runs to the wire or they are waiting to see how it plays out on the stock markets?

They said all Cypriot banks in Greece would be bought for a song by the Bank of Piraeus but this aint occurred as yet and the workers of Laiki Bank in Cyprus said they would go on strike on Tuesday.

Other reports have stated that Putin will confront Berlin if Russian money is touched in Cyprus and strangely enough the oligarch from the Yelstin era Berezovsky who was given asylum by the UK was found dead in his bath.

What is also reported is that Russia would have bailed out Cyprus in totality if it gave them a naval base (as they might lose their only Mediterrenean one in Syria soon) but the Greek Cypriot Finance Minister refused to even discuss this. The Archibishop of Cyprus has called for Cyprus to go bankrupt officially.

Banks have reduced ATM withdrawals now to E100 a day and one cannot see the banks opening on Tuesday without a default/controls being imposed in what one can do with ones accounts in the banks, so this is a trial run to wheel it out across the EZ…as too many banks exist and there is surplus capital that has to be destroyed just like products which cant be sold have to be buried

Agreement Reached – 25th March Greece Independence Day

Two banks are going to shut down, bank deposits over E100k are to be hit (how much and for whom not really clarified), difficult to see how the banks will open as they used to before if capital controls are introduced and some depositors get hit whilst others dont. Its the beginning of DIY banking, in other words they will make it up as they go alone deciding who to steal from and when with no recourse to any rules or laws as they have destroyed their banking system. AKEL complained after calling in the Troika and Anastasiades who is the current premier voted for the Anan plan, so the agenda is to keep the Russians out, gas to go to the Americans and Cypriots to be bankrupted so they can leave the island to big power interests.

The NO vote was just a move to present the scenario as a fait accompli in order to force it onto the Cypriot people.